So… what do the retailers and food service distributors think about vertical farming now?

At this interesting phase where the vertical farming industry currently stands, Netled took a deep dive into the retailers’ and food service distributors’ minds to find out their perspective and future plans regarding sourcing from vertical farms. The results look promising.

For Indoor Agriculture, 2022 ended on a down note, providing much fodder for speculation on the well being of our industry. It was unsettling to those of us dedicated to improving the modern agriculture system and provided no clear direction on where to turn. Often market indicators can be found outside the narrow scope of a single business sector. We thought it wise to tune out the chorus of opinions from indoor agtech experts and gain perspective from other members of the fresh produce supply chain.

Netled partnered with Iowa State University CyBiz Lab to perform a deep dive on market interest in vertical farming from U.S. grocery retailers and food service distributors. How did they interpret the consolidation of CEA growers / suppliers in the last several months? What are their expectations for the market in the short term and the long term? What can their insights tell us about the need for indoor agriculture in the coming years?

In January 2023, a team of four student researchers from agriculture, finance and management disciplines at Iowa State completed U.S. market research on the CEA industry for lettuces and herbs. The CyBiz Lab is lead by Program Direct Mr. Alex Andrade with research and analysis work from Mr. John Imerman, Ms. Morgan Hawkins, Mr. James Chism and Mr. Ian Johnson. The research focused on buyers interest in sourcing vertical farm grown produce and the factors of greatest influence on that interest. The research also sought to understand the dynamic between lettuce and herb buyers and growers.

Reasons not to source from vertical farm depend on the region

Survey participants included category buyers, merchandisers, business development managers, and directors of fresh produce from the top ten US food service and retail distribution companies based on annual sales volume as well as the top fifty US grocery retailers based on regional market share. 42% percent of participants identified as having operations in the Mid-Atlantic states, 27% in New England, 27% in the Mid-west or South and 4% in the West.

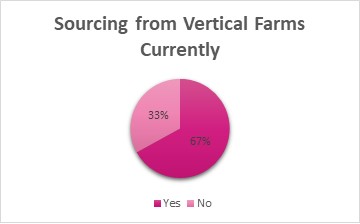

All participants confirmed they currently source organic lettuce and herbs, however only 57% are currently sourcing lettuces from CEA growers and 43% are currently sourcing herbs from CEA growers. 67% had sourced from vertical farm grower suppliers in the last year while 33% had not looked into this sector at all.

As for reasons why this group had not sourced from vertical farms already, the answer seemed to depend on the region. For those in the southern most states, there was lack of demand for high quality product during the winter months and a disbelief that vertical farms could operate successfully in areas of high heat or humidity. To the north, it seemed that the growers were unable to meet the consistent supply of high quality product required. Others said that they were satisfied with seasonal products from local suppliers and did not yet have demand for local product in the colder months. There was also a group of respondents who were still researching options and had not determine which vertical farm company to partner with yet.

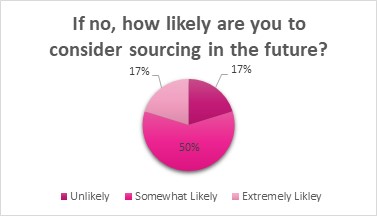

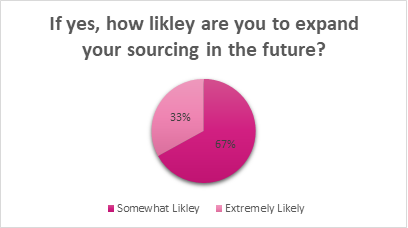

It is also interesting to note that of the group who has not sourced from vertical farms yet, only 17% said it was somewhat unlikely that they would ever source from a vertical farm grower. Of those who are currently sourcing from vertical farms, 33% responded that they are extremely likely to expand sourcing from this sector in the future while the remaining 67% said they were somewhat likely. No respondents replied that they were undecided or not likely.

When asked the reasons why these buyers had sourced from vertical farms in the first place, most respondents listed concerns about supply from California, Arizona and Mexico as well as higher costs that they must pass along to their customers.

Consistency and reliability of supply are the key

Although there are concerns about the consistency and reliability of lettuce and herb supply from vertical farms, there is equal or greater concern about conventional supply for the same reasons. There may not be direct demand from end consumers for vertical farm grown produce yet, but there is hesitation on the part of the retailer and distributor in not offering these alternatives to their customers. It is reasonable to infer that there will be forgiveness in the supply chain as the vertical farm industry improves upon growing techniques and financial planning to ensure the success of their businesses. As one retailer noted, “it is now the responsibility of the grower and the retailers to successfully market vertical farm grown produce and educate the consumer on the benefits”.

At Netled, we interpret that as a sign of great things to come for our industry. We recognize the importance of building strong partnerships with our business customers and focusing efforts on promoting our industry and educating our end consumer. We are also confident in both our proprietary Vera® vertical farm technology and our farm management abilities. The data points we are monitoring at our two commercial scale farms in the Nordics as well as our demo farm in Canada continue to outperform expectations. This is on levels of energy consumption as well as quality of the product. We look forward to discussing our research findings and sharing information on our commercial scale Vera® vertical farm systems at Indoor Ag-Con and The NGA Show later this month. You’ll find Netled at the booth #517 and CEO Niko Kivioja speaking at the panel ‘Hardball: The State of the Vertical Farming Industry’ on Monday at 2:00pm.

At Netled, we interpret that as a sign of great things to come for our industry. We recognize the importance of building strong partnerships with our business customers and focusing efforts on promoting our industry and educating our end consumer. We are also confident in both our proprietary Vera® vertical farm technology and our farm management abilities. The data points we are monitoring at our two commercial scale farms in the Nordics as well as our demo farm in Canada continue to outperform expectations. This is on levels of energy consumption as well as quality of the product. We look forward to discussing our research findings and sharing information on our commercial scale Vera® vertical farm systems at Indoor Ag-Con and The NGA Show later this month. You’ll find Netled at the booth #517 and CEO Niko Kivioja speaking at the panel ‘Hardball: The State of the Vertical Farming Industry’ on Monday at 2:00pm.

Read more: https://netled.fi/

Kasey Snyder is Sales Operations Manager at Netled, supporting new business development globally. As a native of New Jersey, she has lived in Finland for the last seven years and enjoys exploring international opportunities to expand vertical farming.